How 5-Minute Intraday Candles Move Based on CPR Widths

How 5-Minute Intraday Candles Move Based on CPR Widths:

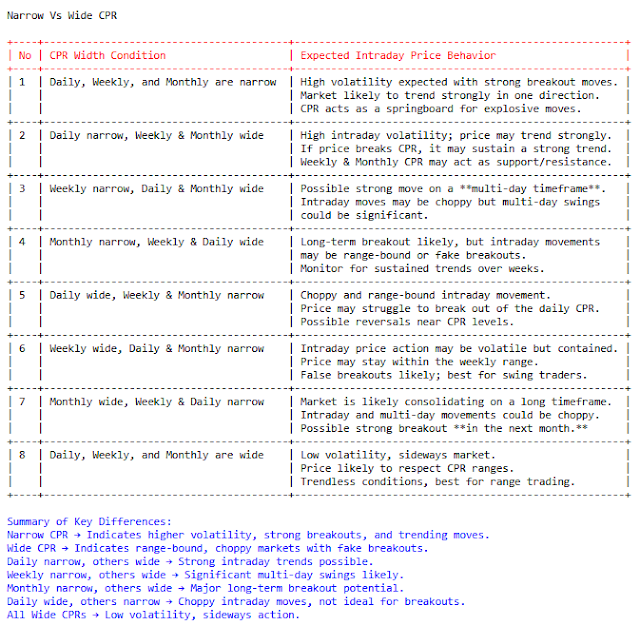

1️⃣ Daily, Weekly, and Monthly CPR are narrow:

- Expect high volatility and strong trending moves.- 5-minute candles will likely break out forcefully in one direction.

- Little to no pullbacks, price moves quickly away from CPR.

2️⃣ Daily CPR is narrow but Weekly and Monthly are wide:

- Intraday breakouts possible, but moves may lack follow-through.

- Initial strong 5-minute candles may fade later as higher timeframes resist.

- Initial strong 5-minute candles may fade later as higher timeframes resist.

- Good for scalps and quick trades, but watch for false breakouts.

3️⃣ Weekly CPR is narrow but Daily and Monthly are wide:

- Intraday moves align with higher timeframe trends.

- 5-minute candles may start slow but develop into a strong trend.

- Intraday moves align with higher timeframe trends.

- 5-minute candles may start slow but develop into a strong trend.

- Watch for small breakouts that expand into bigger multi-day moves.

4️⃣ Monthly CPR is narrow but Weekly and Daily are wide:

- Choppy intraday movement, lots of whipsaws in 5-minute candles.

- Market lacks direction, expect stop runs and quick reversals.

- Choppy intraday movement, lots of whipsaws in 5-minute candles.

- Market lacks direction, expect stop runs and quick reversals.

- Major breakout could be coming soon, but not necessarily intraday.

5️⃣ Daily CPR is wide but Weekly and Monthly are narrow:

- Intraday range-bound trading, price respects Daily CPR.

- 5-minute candles likely to reverse frequently, better for mean-reversion strategies.

- Intraday range-bound trading, price respects Daily CPR.

- 5-minute candles likely to reverse frequently, better for mean-reversion strategies.

- Difficult for trend traders, but good for scalping within CPR zones.

6️⃣ Weekly CPR is wide but Daily and Monthly are narrow:

- Intraday volatility exists, but larger trends don’t form easily.

- 5-minute candles may show sharp moves but no sustained direction.

- Intraday volatility exists, but larger trends don’t form easily.

- 5-minute candles may show sharp moves but no sustained direction.

- Expect fake breakouts and frequent pullbacks to CPR.

7️⃣ Monthly CPR is wide but Weekly and Daily are narrow:

- Difficult intraday trading, 5-minute candles lack momentum.

- Price mostly respects Monthly CPR levels, making it a slow day for traders.

- Difficult intraday trading, 5-minute candles lack momentum.

- Price mostly respects Monthly CPR levels, making it a slow day for traders.

- Long-term range being built, intraday scalps may struggle.

8️⃣ Daily, Weekly, and Monthly CPR are wide:

- Market is likely in a long-term range, with weak momentum.

- Best for option sellers, worst for momentum traders.

🔹 Key Takeaways:

- Narrow CPRs = More Volatility

- Wide CPRs = Choppy, Range-bound Market

- Daily narrow + Higher Wide = Quick intraday trades, false breakouts possible

- Wide CPRs = Choppy, Range-bound Market

- Daily narrow + Higher Wide = Quick intraday trades, false breakouts possible

- Higher narrow + Daily Wide = Slow start, but potential big multi-day trend

Comments

Post a Comment